Insurance companies in Kenya for Rural Farmers

Rural Kenya has limited supply of the essential components that make life worth living like hospitals. This means that people can die anytime just because they could not get the much-needed medical care. This can be worse if the person who dies is the breadwinner of the family. Farming and agriculture caters for a huge percentage of the country’s annual income. Despite this, the rural regions have not been supplied with sufficient insurance companies in Kenya to help make life much simpler. When the breadwinner dies, the bills will not stopping coming. The family might be left in abject poverty even if they were the richest around.

Nevertheless, there is hope for the people of rural Kenya, with the emergence of cheap insurance policies that can help in easing the burden caused by the loss of the main person. Insurances will step in and help in making the bills disappear, while still giving the family enough money to take care of themselves. If a family member fall ill and needs specialized medical care away from the farm, insurance will still be able to chip in and help in settling the hospital bills. This comes as a huge relieve of the farm owner, in case this happen during the planting season when all the money has been spent on planting.

-

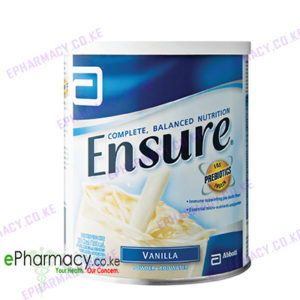

ENSURE ORIGINAL NUTRITIONAL POWDER (VANILLA) – 400GM

KSh3,120.00 Add to cart -

GOLD STANDARD 100% WHEY | OPTIMUM NUTRITION | MASS WEIGHT GAIN – 2lbs

KSh6,750.00 Add to cart -

J-CHEN HIP UP | BUTT | BOOTY | HIPS ENHANCER SUPPLEMENT – 100 Capsules

KSh6,500.00 Add to cart -

TRIMETABOL SYRUP | APPETITE | WEIGHT GAIN – 150MLS

KSh800.00 Add to cart

The problem with most people in Kenya today is that they do not believe in insurance companies in Kenya until they see them work. This might be too late, especially when death is the question. Funeral services could be very expensive, more so when the deceased died in a faraway place and the relatives have to bring the casket all the way to the farm for burial. Transport and body preservation services do not come cheap, and these services alone could cut savings into half. It is important that farm owners think about these issues instead of waiting for them to happen and face the consequences.

InsureAfrika: companies in Kenya

Different insurance companies in Kenya provide different kinds of life insurance policies for farming and agriculture people in the rural areas. Depending on the size of land and the kind of farming you practice, you can get a variety of covers. Other reason that will determine the extent of your cover will be the proximity of your farm to potential hazard causers like petrol stations. In acquisition, the farmer can get a cover that covers the owner only, the owner and the farm or the owner, the farm and the family.

Nobody can tell what the future holds in store, but everyone can prepare for it. A cover that has a debt repayment strategy is a good policy that can help in paying off the debt, when the debtor is unable to do so. At times, the weather and climate conditions do not know how much work has been put in ensuring that the plants grow. Climate changes mean a direct loss of income, which can be covered by taking up an income protection cover. The same plan can also be used in lowering your taxes.